working capital turnover ratio ideal

Debt to Equity Ratio. To be converted into our store.

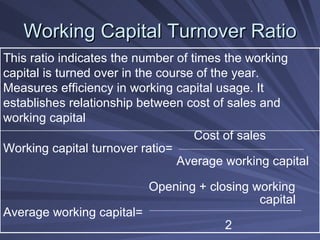

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Net Sales Net Working Capital.

. One companys working capital will be different from another similar company so comparing them may not be ideal for using the concept. Definition of Ratio Analysis. Cash Flow Analysis Techniques and Tips.

We would like to show you a description here but the site wont allow us. The Quick ratio Quick Ratio The quick ratio also known as the acid test ratio measures the ability of the company to repay the short-term debts with the help of the most liquid assets. It is calculated by adding total cash and equivalents accounts receivable and.

A set of Trend Data Driven Chart are included. Since capital structure ratios reveal these facts analyst pay careful attention to them. The ratio of Inventory Turnover Total cost of all the goods soldaverage cost of the inventory.

The second name for working capital is net working capital. Ideal for Quarterly Reviews or Annual presentations. Visit SBI Mutual Fund to invest in SBI Blue Chip Fund.

The compression ratio is the ratio between two elements. We aim to serve the nearby residential community and working class of Manhattan by proving them all they need under a single roof. The compression ratio of an engine is a very important element in engine performance.

A positive net working capital indicates that a company has a large number of assets while a negative one indicates that the company has a large number of liabilities. Operating Income. SBI Bluechip Fund - Check out the fund overview NAV returns portfolio performance etc.

When to Use It. A working capital ratio above 2 indicates lost business opportunities and poor financial management. 10 Facts You Should Know About Business Assets.

Liquidation of the Firm. This structure is ideal for companies where sales rep retention is critical to the success of the sales organization. Thus an ideal capital structure is one that provides enough cushions to shareholders so that they can leverage the debt-holders funds but it should also provide surety to debt holders of the return of their principal and interest.

This helps people work in such a way that their activities are aligned with the organization strategy and helps individual work areas contribute to overall business. Income and Expenses Chart. However a capital-intensive company will have a different ratio and in the case of negative working capital the ratio might reverse in most cases.

A higher ratio indicates that the companys funds are efficiently used. An ideal situation is where performance indicators cascade down through an organization. Ratio analysis can be defined as the process of ascertaining the financial ratios that are used for indicating the ongoing financial performance of a company using a few types of ratios such as liquidity profitability activity debt market solvency efficiency and coverage ratios and few examples of such ratios are return on equity current ratio quick ratio.

ABCs Current Ratio is better than XYZ which shows ABC is in a better position to repay its current obligations. The standard salary to commission ratio is 6040 where 60 is fixed and 40 is variable. Understanding Sales to Working Capital and Turnover Ratio.

The company is actively investing in the success of a given rep while incentivizing their performance. A KPI Tree is a visual method of displaying a range of measures in an organization or related to a project. 60 of companies investing in data-based HR technology said they had average turnover rates of up to 20 and 25 of the organizations had turnover rates of up to 50 71 of Millennials say an organizations view of technology will influence whether they want to work there and 66 of Gen Xers and 53 of baby boomers feel similarly CompTIA.

This policy is known as the. The gas volume in the cylinder with the piston at its highest point top dead center of the stroke TDC and the gas volume with the piston at its lowest point bottom dead center of the stroke BDC. The ideal ratio should be 2 is to 1 in the case of manufacturing companies.

The location is ideal for opening convenience store since it is amidst all commercial and business. On August 20 2020 the Ministry of Housing and Urban-Rural Development and the Peoples Bank of China held a joint symposium with Chinas largest property developers Country Garden 碧桂园 Evergrande Group 恒大集团 and Vanke 万科 and proposed to implement a policy to monitor and manage loan regulations for the real estate sector. Return on Assets ROA Ratio.

The ratio between 12 and 20 is regarded as the most ideal ratio. Net Working Capital Ratio.

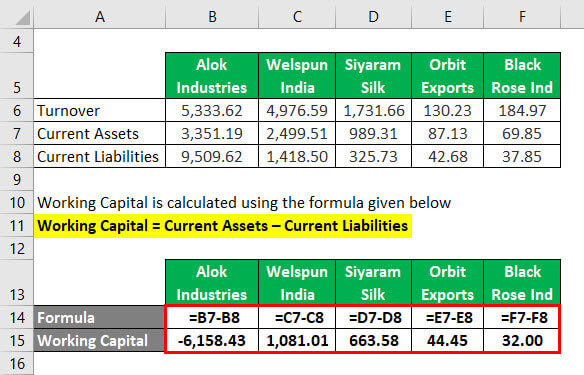

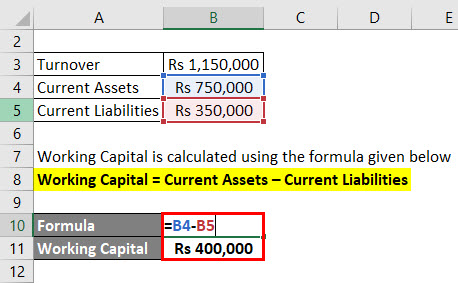

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratios Universal Cpa Review

Working Capital Turnover Ratio Formula And Calculator

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratios Universal Cpa Review

What Is The Formula For The Working Capital Ratio Quora

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Ratio Analysis Example Of Working Capital Ratio

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Cycle Efinancemanagement

Working Capital Turnover Efinancemanagement Com

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

Working Capital Formula Components And Limitations

Working Capital Turnover Ratio Meaning Formula Calculation